Staffing firms face added challenges when it comes to effectively communicating with employees. Unfortunately methods such as gathering the team into a conference room, conducting a lunch-and-learn, having conversations in the hallway, or posting fliers in the break room fall short of informing all employees of major procedural changes. With employees dispersed across your region – or even across the country – you often do not have an opportunity to see them face-to-face on a regular basis.

Staffing firms face added challenges when it comes to effectively communicating with employees. Unfortunately methods such as gathering the team into a conference room, conducting a lunch-and-learn, having conversations in the hallway, or posting fliers in the break room fall short of informing all employees of major procedural changes. With employees dispersed across your region – or even across the country – you often do not have an opportunity to see them face-to-face on a regular basis.

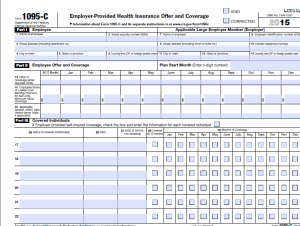

This adds a level of complexity when it comes to educating your employees and preparing them for the new regulations introduced by the Affordable Care Act (ACA). With a population of dispersed team members, it’s crucial that staffing companies have a fully developed plan in place to educate employees about the Affordable Care Act’s Form 1095-C, including what it is and what they will need to do with the new required tax form.

The deadline to provide the 1095-C to your employees is quickly approaching, but you can reduce confusion and administrative tasks by preparing your employees for what’s to come. Consider the following questions employees may have about the Form 1095-C and suggestions as to how you might answer them.

Why did I get a Form 1095-C? Employees working full-time for an average of 30 hours or more per week and enrolled in health insurance through their employer at any time throughout 2015 will receive the form.

Why didn’t I get a Form 1095-C? Employees not working full time and not enrolled in health care coverage through their employer any time in 2015, will not receive a 1095-C. Employees who are not the primary insured individual in their household also will not receive a 1095-C.

What information is on the form? The Form 1095-C is divided into three sections, the first of which reports information about you and your employer. The second includes information about the coverage offered to you by your employer, the affordability of that coverage and why you were or weren’t offered coverage. The third section presents information about the individuals covered under your plan, including any dependents.

Why was Part 3 (the third section) of the form left blank? Part 3 of Form 1095-C could be left blank for several reasons, including the employee not being enrolled in coverage through its employer for any month of 2015. Additional reasons could be having coverage through a fully-insured plan, being covered through COBRA or being a union employee.

What should I do with my 1095-C? Keep your 1095-C for your records with your other important tax documents. While you will not need to attach your 1095-C to your tax return or send it to the IRS, you may use information from your 1095-C to help complete your tax return.

How will 1095-C affect my taxes? Form 1095-C is used to verify that you were offered health insurance coverage by your employer. If you did not elect to be covered and do not qualify for an exemption, you may be subject to a fine when you file your 2015 tax return. Or, if there’sa discrepancy inthe information that you and your employer report to the IRS about the health care coverage offered to you, your tax return may be delayed.

Having a plan to communicate why they are receiving the form, when they will receive it, what they must do with it, and who they should contact for more guidance is crucial to an effective strategy in educating your employees. Providing regular communications will also help reduce the number of questions you may receive and the number of requests for reprints for those who may have tossed their 1095-C not knowing what it was.

Equifax Workforce Solutions has created a sample communication plan and materials to help employers educate their employees on the new tax form. For access to resources like videos, emails and posters, visit workforce.equifax.com/1095Info. You can also visit www.mytaxform.com for frequently asked questions and answers about the 1095 as well as a Form 1095-C decoder that explains the form’s indicator codes.