Temporary staffing companies continually face the challenge of balancing the need to provide employee benefits to attract high quality candidates for placement with the need to maximize profit margins. This has become even more challenging in light of the looming effects on the industry of compliance with the Affordable Care Act. That’s a lot to balance. Few employee benefits can achieve the lofty goal of being a meaningful benefit to employees while actually saving money for the employer offering the benefit.

Temporary staffing companies continually face the challenge of balancing the need to provide employee benefits to attract high quality candidates for placement with the need to maximize profit margins. This has become even more challenging in light of the looming effects on the industry of compliance with the Affordable Care Act. That’s a lot to balance. Few employee benefits can achieve the lofty goal of being a meaningful benefit to employees while actually saving money for the employer offering the benefit.

Increasingly, the staffing industry is taking advantage of commuter benefits as a way to cut payroll taxes and increase the effective pay rate of both its full time and temporary employees on assignment. It seems counterintuitive that an employee benefit program can actually save a staffing firm money, but an increasing number of companies are finding it possible to do just that.

“Commuter Benefits are a no brainer. If you aren’t taking advantage of them already – you should. Annually, it saves us thousands of dollars in payroll taxes and at the same time raises our temporary employees’ effective compensation.” said Peter Delaney, HR Manager, Staff-Line Inc. “It’s like giving them a raise!”

Since 1992, the IRS has allowed employers to offer employees a pretax benefit for commuting by public transit or to pay for commuter parking. The benefit is a win-win for employees and employers alike. Employees can save on the cost of commuting by reducing their income taxes and their employer can save on payroll taxes with every participating employee’s pretax payroll deduction.

Employees can deduct from their paycheck before taxes up to $130 per month for public transit (subways, buses, vanpools, ferry, rail etc.) and up to $250 per month for qualified parking. The tax savings works just like when employees take deductions to fund their 401(k). The associated savings really add up.

Here is how it works.

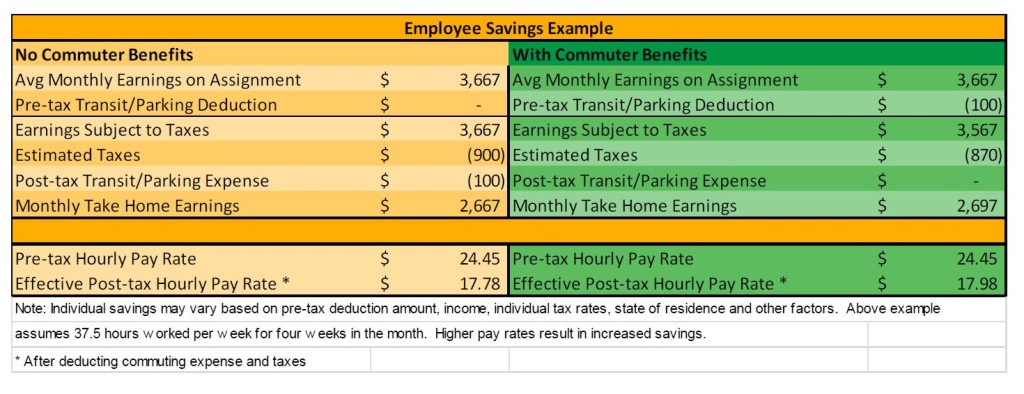

When an employee pays part or all of the cost of commuting to work via a pretax payroll deduction, the employee’s federal gross taxable income is reduced. State gross taxable income is also reduced in most states. This means that the employee pays taxes on a lower gross income which puts more money in their pocket.

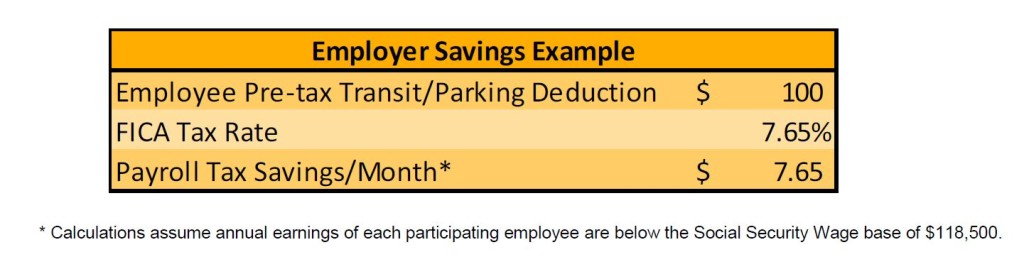

And the staffing firm that employs this individual would pay payroll taxes only on the reduced gross taxable income, saving approximately $7.65 in monthly payroll taxes on this one employee based on the above example.

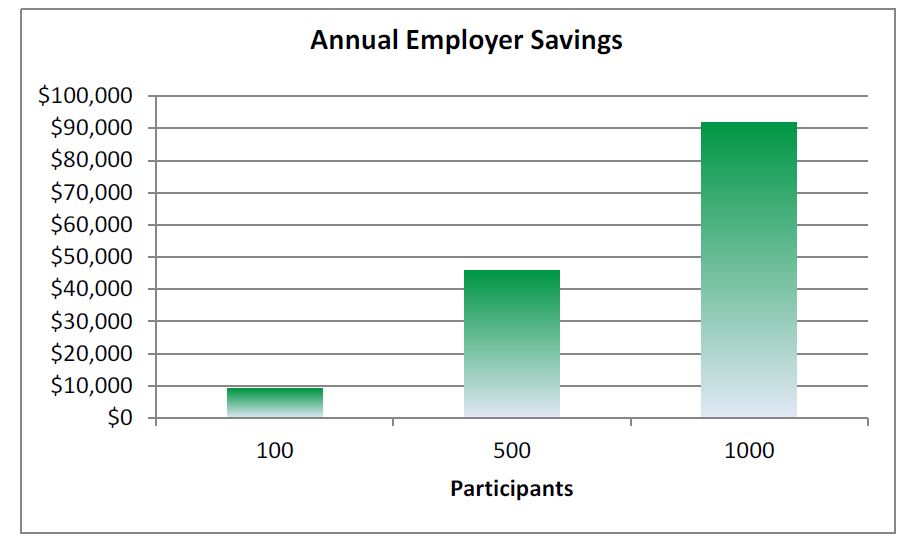

Multiply the savings by the number of employees participating each month and the savings can be significant – creating a win-win for staffing firms and their employees.

Staffing firms are uniquely positioned to save significantly with commuter benefits as full time employees, or those on temporary assignment, can participate in the savings program. By offering commuter benefits, staffing firms increase the effective compensation paid to workers while realizing a reduction in company payroll taxes. The benefit can also be offered as a fringe benefit to reward productivity or provide an incentive to minimize unscheduled time off or remaining on assignment for a specified length of time. It’s a cost-effective way to keep workers, clients and CFOs happy.

Commuter benefit program administrators such as WageWorks and TransitChek provide programs that are easy to set up and administer. A monthly administration fee applies only for employees who participate. Savings typically exceed fees associated with administration of the program—resulting in a meaningful benefit offering that saves money for both temporary and full time employees as well as the staffing firm that employs them.

“Commuter Benefits are great for staffing firms,” according to Michael Susko, HR benefits manager, Central Staffing Services Inc. “It really does affect our bottom line. It reduces our payroll taxes while saving our employees money on their commute. It’s that simple.”

Unlike traditional benefits such as health insurance, a commuter benefit program does not have an annual open enrollment period. This means that temporary and full time employees can add or remove themselves from the program at any time during the year and the staffing firm can begin offering the program at any time.

Temporary and full time employees may also temporarily suspend their benefit at any time. This is useful during times when these employees are not out on an assignment.

The ability to increase the take home pay of employees while reducing your company’s payroll taxes could be used to differentiate your staffing firm from those that don’t offer such a benefit. And many staffing firms are beginning to do just that.

According to an October 2014 Staffing Industry Analysts survey on staffing company benefits, professional staffing firms tend to offer more benefits to temporary workers than commercial staffing firms, and larger staffing firms (> $10 million in revenue) tend to offer more benefits than smaller staffing firms. But it seems staffing firms of all sizes are beginning to use commuter benefits. This is likely to continue as local markets (including San Francisco, New York and Washington D.C.) implement laws requiring certain companies to offer commuter benefits to their employees.