In a post last year, I explained why selling before the M&A cycle peaks has more impact on valuation than company performance. I’ve since been asked to expand on that important subject, including what an optimum combination of M&A cycles and company performance would look like. And bottom-line, which of the two metrics (cycle or performance) is the more practical indicator for an owner to use when planning an exit?

In a post last year, I explained why selling before the M&A cycle peaks has more impact on valuation than company performance. I’ve since been asked to expand on that important subject, including what an optimum combination of M&A cycles and company performance would look like. And bottom-line, which of the two metrics (cycle or performance) is the more practical indicator for an owner to use when planning an exit?

To get a better understanding of these important issues, in this post I dig a little deeper into what causes M&A cycles to go up and down as well as how best to time them. We’ll then review the evolution-growth phases of a typical company to better pinpoint ideal timing from that standpoint. Next week, I’ll cover what to keep in mind when attempting to combine them for maximizing your exit value – and answer the bottom-line question of which metric offers the best guide when selling.

The Anatomy of an M&A Cycle. Over the last century, M&A cycles have generally come in waves. Each wave was driven by increasing “animal spirits,” (emotion-driven confidence) and fueled by high equity valuations and easy credit. This abundant liquidity was used during each wave to accomplish different goals, including horizontal consolidations, vertical integrations, cross-border combinations and the need to address technological innovation/disruptions.

The end of each wave variously coincided with regulatory change, volatility brought about by unexpected crisis, collapse of stock values, tightening credit — and economic contraction/collapse. If you are interested in a research summary of M&A cycles – see page 56 of this article.

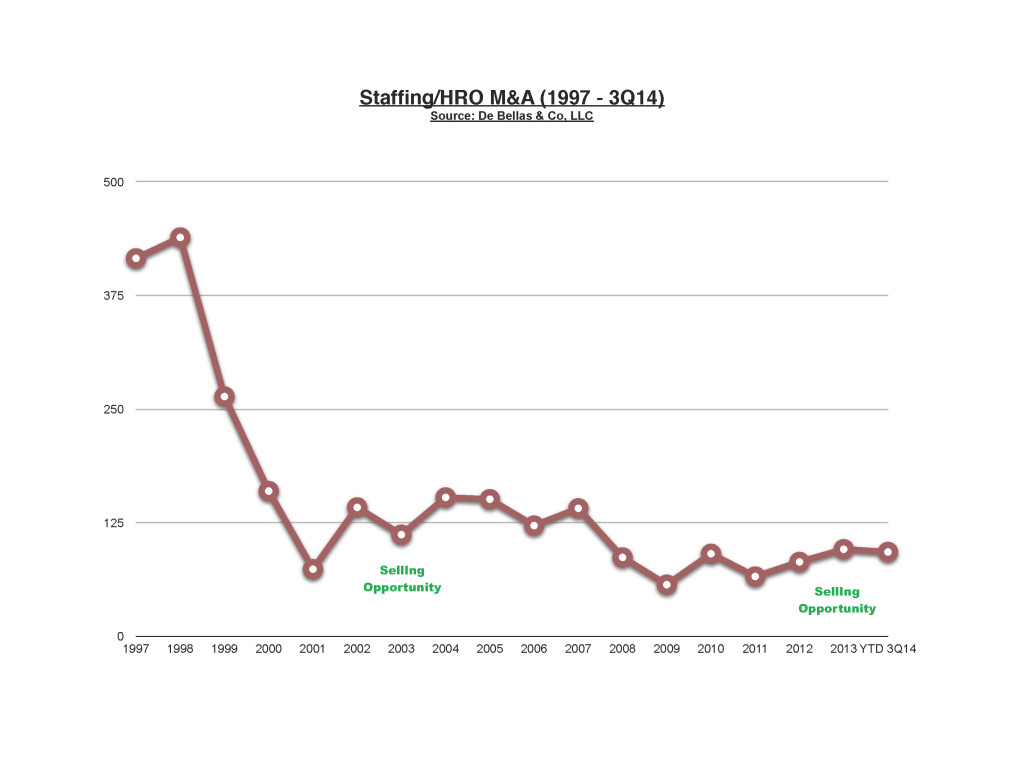

In recent times, staffing transaction cycles have roughly coincided with the U.S. (1992-2001) and (2003-2007) M&A waves. The 1998 staffing/HRO M&A peak was fueled by elevated stock valuations that drove fevered horizontal consolidations, cross-border acquisitions, and later defensive moves into IT verticals. The (2003-2007) mini-wave was again driven by easy credit and continued focus on vertical integration, specialized IT, medical, and consolidation. Both cycles ended with a rapid drop in public equities and tightening of credit – brought about by what is popularly known as the bursting of the dot-com and sub-prime lending bubbles.

PREMIUM CONTENT: 2014 Staffing Company Survey: Reported M&A multiples and activity

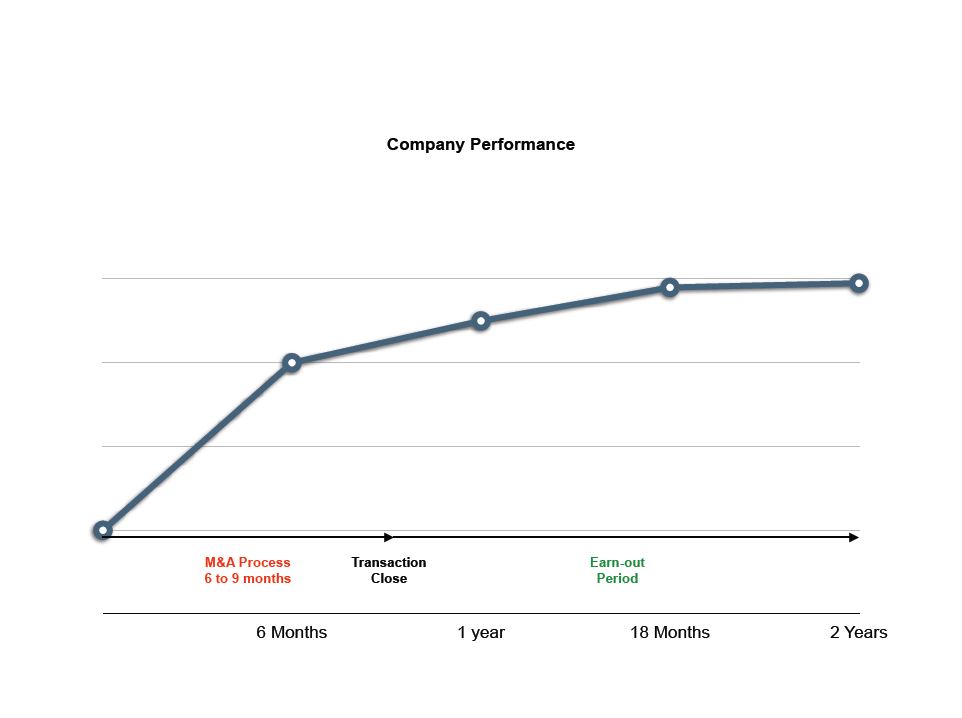

Timing the Wave. In my experience the best time to enter the market is a minimum of 9 months to a year before the M&A cycle peaks. This is when animal spirits are high and buyers are most likely to agree to higher valuations. The idea is to allow for the 6 to 9 months it typically takes to sell your company before those animal spirits begin to wane. We’ll also discuss the importance of sustaining post-sale earnings when we get to timing your company performance below.

As you can see from the the following chart of publically announced M&A transactions, most waves have ended rather abruptly. Of course, the ideal time is easy to see on a historical chart, but it is very difficult to spot at the time. How many analysts accurately called the end of the last two bubbles?

The Evolution of Company Performance. Companies normally go through a number of stages: seed funding, startup, initial growth, maturity, sustained expansion, and decline. Unless you are a technology-based company, it’s during the expansion phase when most of us begin to seriously consider selling. This is when we are thinking of retiring and/or we (and our shareholders/lenders) become less comfortable with the added financial and operating risks associated with sustaining economic growth (SEG).

The Evolution of Company Performance. Companies normally go through a number of stages: seed funding, startup, initial growth, maturity, sustained expansion, and decline. Unless you are a technology-based company, it’s during the expansion phase when most of us begin to seriously consider selling. This is when we are thinking of retiring and/or we (and our shareholders/lenders) become less comfortable with the added financial and operating risks associated with sustaining economic growth (SEG).

Timing Performance. Once we decide to sell, the best time to begin the process is again well before our company’s performance begins to taper or peak. When making this decision it’s important to remember the 6-9 months it typically takes to market your company. It is also essential to remember that maximizing your value requires not only sustained sales and earnings leading up to the sale, but also convincing the buyer of growth potential following the sale. After-sale performance is especially important when an earn-out is part of your pay-out.

Once again choosing the right time isn’t easy to achieve, but doable if you err on the side of being early, rather than being too late from a performance standpoint. Unlike predicting the M&A cycle, most of us have a pretty good idea when we are nearing our present growth capacity, or competition is beginning to mount. As I can testify, waiting to begin the process until things begin to get difficult and sales/earnings flatten out or wane is not a good idea. This article has more information on how to determine when you are at your capacity for sustainable growth.

Next week, I’ll tie together the topics of M&A and company performance cycles, discussing what the optimum combination of M&A cycles and company performance would look like. We’ll then get to the bottom-line by suggesting which to choose for timing your own exit.

MORE: Why “keeping your eyes on the road” is so critical when selling your firm

ñåðèàë íà òåëåôîí

ñåðèàë íà òåëåôîí

[…] The Staffing Stream […]