Is chocolate really favored over peanut butter? Yes. Internet polls don’t lie. A quick search turned up several chocolate vs. peanut butter polls to fit the story line of this series on controls: post-award controls (chocolate) and pre-award controls (peanut butter) are very different, and the optimal solution requires protections on both sides of the contract. Full disclosure: I did not read all the polls that came up in my query. Instead I made a personally biased assessment that chocolate beats peanut butter, hands down, every time … because it does.

Is chocolate really favored over peanut butter? Yes. Internet polls don’t lie. A quick search turned up several chocolate vs. peanut butter polls to fit the story line of this series on controls: post-award controls (chocolate) and pre-award controls (peanut butter) are very different, and the optimal solution requires protections on both sides of the contract. Full disclosure: I did not read all the polls that came up in my query. Instead I made a personally biased assessment that chocolate beats peanut butter, hands down, every time … because it does.

Context

In part 2 of this series, we explained how the effectiveness of pre-award controls lags behind the company’s development of spend data visibility. In part 3, we examined the abstract nature of procurement preferences and how that tends to stunt pre-award control adaption early on in the services procurement maturity curve.

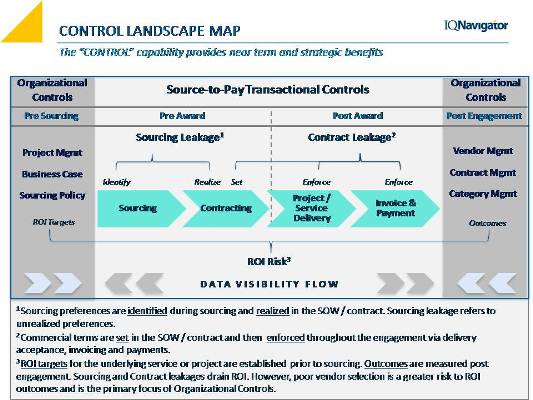

But putting pre-award risks and controls into proper context relative to the Control Landscape Map (Figure 1) does not fully explain the power and impact of the post-award transactional quadrant. So, we dedicate this and future posts to that end and will describe what chocolate really is and why it is preferred 3-to-1 by procurement professionals!

Figure 1 – Control Landscape Map

Post-award Risks

The risks that organizations are exposed to after execution of an SOW are correctly, but often too simply, described as contract noncompliance. The contract entails commercial terms that need to be adhered to, but also there is (should be!) an expected outcome related to the underlying project or service delivery, not the least of which is return on investment. The following is a partial list of specific engagement management (i.e. post-award) risks that warrant protection by post-award transactional controls:

- Inaccurate payment

- Inaccurate invoice

- Inaccurate or incomplete invoice line item data

- Unmet acceptance criteria*

- Unmet service-level agreement*

- Poor project outcomes**

- Poor supplier performance

- Budget overruns**

- Negative ROI impacts

- Negative risk shifts (risk added to pre SOW risk position)

- Reputational risks

- Regulatory risks

- SOW worker related risks (asset security, regulatory, onboarding)

- Relevant spend, vendor, procurement data not captured (as required for category improvements, SPM, etc)

*Whether payment’s made or not

** Not always the supplier’s fault

PREMIUM CONTENT: Best (and worst) decisions made

Contract Leakage

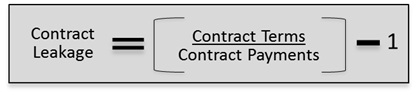

Figure 2 presents the formula for calculating contract leakage. Note that it can be applied to individual contracts, to vendors, to categories, and it is especially relevant to business cases at the services portfolio level. Negative results indicate leakage. Positive results indicate inaccuracies as well, but with the supplier(s) on the losing end.

Figure 2 – Contract Leakage Formula

“An ounce of prevention is worth more than a cut of the cure”

It is worth noting there is an entire industry dedicated to serving companies with material contract leakage issues. Profit recovery firms conduct payment/invoice matching audits (after the fact of course) to find duplicate payments, inaccuracies and unrecovered credits. Then they go collect the over payments from the companies’ vendors and take their well-earned but not insignificant cut of the recovered bounty. This profit recovery cure can cost 10-20% of spend recovered. That is a high premium to pay when preventative controls tend to cost well below 5% of spend.1 Especially considering profit recovery is a recurring point solution, meaning it does not address the root issues that caused the overpayments in the first place (aka lack of controls).

Post-Award Controls

There are some nuanced differences embedded in the post-award risks that warrant a few distinctions in how we classify their controls:

Transaction-based contract compliance. Ensure invoice and payment accuracy and compliance with actual contract terms.

Outcome-based contract compliance. Ensure accountability relative to the underlying project or service.

ROI preservation (aka budget compliance). Controlling the total spend of the SOW engagement’s underlying project or service relative to the investment being made. This tracking control reveals both supply and demand side issues.

Procurement preference realization.Pre-award controls help ensure identified savings and other preferences make it into the contract; post-award controls help ensure those preferences are realized. Think of this class of control as part two or an extension of the pre-award controls already discussed – the value being protected is the same (i.e. procurement preferences).

In our next post in this series, we will take a look at the post-award control solution – simple, yet complicated … like a fine wine chocolate should be.

1 Combined VMS and MSP solution, including variable and fixed costs over time.